Seeking health insurance through ALC Health will not only provide you with a wide range of affordable and comprehensive international cover against medical expenses but set you up with a plan approved for residing in Germany.

Further to this, they have their own 24/7 "in-house" claims team to assure swift settlements and assistance whenever needed, offering 8 toll-free numbers, including one for their customers living in Germany.

Why we would choose ALC Health…

When asked to cherry pick ALC Health’s unique selling points, it has always been a pleasure to assure our clients that ALC welcome applicants up to the age of 74 along with guaranting lifetime renewals without claim-related premium increases, regardless of the ailment during the customer's time with them.

Also, offering direct billing at private Helios clinics in Germany, worrying about settling invoices is a matter of the past too. And should an outpatient claim need to be submitted by the customer themselves, ALC provide a full-featured Customer Portal for quicker means of communication using webchat and swifter claim handling.

Lastly, arriving in Germany as an expat, assurances are key to settling in smoothly. Health insurance playing a crucial part, ALC Health's 'Global Prima Medical Insurance' plans are recognised at the German Foreigners' Office, therefore no nasty surprises of having purchased just travel insurance when applying for a resident/ work permit.

2 Ways to insure yourself with áLC Health

1. Full Medical Underwriting

áLC Health cover most medical conditions and to access the health status require answers on 16 medical questions.

These include questions about disorders to: digestion, gynaecological parts, ear, endocrine system, eye, heart or blood vessels, liver and gall bladder, mental status, metabolism, neurological functions, nose, respiratory system, skin, throat, teeth, urinary tract and also ALC want to know if any medical issues are related to: AIDS & HIV, cancer, growths, cysts, moles, muscular or skeletal problems and tumours.

2. Moratorium Clause

Any medical condition for which, within the 5 years prior to date of entry as shown on the Certificate of Insurance, the insured person:

a) had experienced and or suffered from any signs or symptoms, whether investigated or not;

b) had sought or received advice;

c) had been recommended to have or had received medical treatment, including lifestyle changes and special diets, drugs,

medication and injections; or

d) to the best of the insured person's knowledge, was aware he/she had.

After a continuous period of 2 years of insurance cover with ALC Health, any pre-existing conditions that were excluded will be insurable providing the insured person has not:

a) experienced and or suffered from any signs or symptoms, whether investigated or not;

b) sought or received advice;

c) been recommended to have or have received medical treatment, including lifestyle changes and special diets, drugs, medication and injections.

for that specific condition.

ALC Health in Germany

The majority of our clients in Germany insured by ALC Health are expats, freelancers, self-employed or students in major German cities like Aachen, Berlin, Cologne, Dusseldorf, Frankfurt, Hamburg, Munich, Stuttgart and from our experience remain insured with ALC as an international provider for as long as they are legally entitled to.

Furthermore, through us our clients are able to sign up for compulsory German Long-Term-Care insurance, also know as "Pflegepflichtversicherung" (PVN). For more information on 'PVN' please follow this internal link.

Quick-View

- Contact - Private Clients

To share sensitive data such as credit card/ bank details, updates on your health condition, changes to your current plan or to submit claim relevant documentation we stongly advise to use ALC's Secure Messaging (link) before considering the following means.

Application forms:

privateclient@alchealth.com

Renewal queries:

renewals@alchealth.com

Personal details and contractual matters:

privateclient@alchealth.com

Claims:

claims@alchealth.com

Germany - 0800 664 4832 (Freephone)

Gibraltar - 200 669 59

Hong Kong - 800 965 313 (Freephone)

Malta - 800 621 89 (Freephone)

Philippines - 1800 111 020 96

Customer complaints can be filed using email: managingdirector[at]alchealth.com

- Offices

Head Office:

3rd Floor, Fitzalan House,

Cardiff, CF24 0EL,

United Kingdom

T +44 (0) 1903 817 970

F +44 (0) 1903 879 719 - Plan Range

Global Prima Medical Insurance

- Platinum

top of the range plan with the very best medical services available across the globe and an extensive range of medical treatments available

Overall policy limit: 5 million EUR | USD | GBP

- Gold

mid-range plan with hardly any exclusions, out-patient limit is paid up to the maximum plan limit and access to the comprehensive support programme

Overall policy limit: 4 million EUR | USD | GBP

- Silver

richer benefits than Bronze Plus plan, including benefits such as routine health checks

Overall policy limit: 3 million EUR | USD | GBP

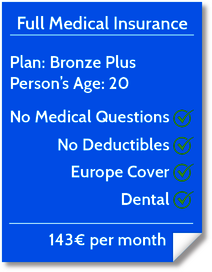

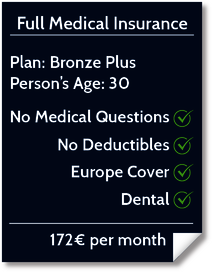

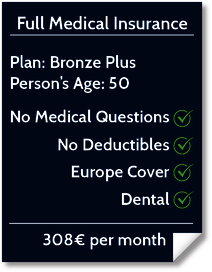

- Bronze Plus

most economic plan, covering essential costs of in-patient, day-patient and out-patient treatment

Overall policy limit: 2 million EUR | USD | GBP

Available annual excesses:

Euros: Nil | 50| 150 | 300 | 500 | 1,000 | 2,500 | 5,000 | 7,500

GBP: Nil | 50 | 150 | 300 | 500 | 1,000 | 2,500 | 5,000 | 7,500

USD: Nil | 50| 150 | 300 | 500 | 1,000 | 2,500 | 5,000 | 7,500Available areas of covers:

Europe | Worldwide excluding the USA and any USA territories | WorldwideMandatory 50% co-insurance

For treatment received in the USA and outside of the PPO NetworkEXCLUSIONS:

aLC Health's GMPI plans list a total of 68 general exlusions but not all apply to every plan.

A detailed description can be found in their Policy Wording, pages 13/14. (link)The following pre-existing conditions are generally not insurable though:

Arterial disease, cataract, diabetes, diabetic renal disease, diabetic retinopathy, ischaemic heart disease, stroke.

Addictions/Misuse of substances

Congenital anomalies,

except where covered under Newborn Cover

Development delays/disorders

Expenses arising from or related to ...

- claims submitted later than 6 months after the end of the period of cover, unless not reasonably possible

- completion of claim forms and any other documents or administration costs

- excessive, unreasonable and uncustomary invoices for the type of treatment and location treatment was received

- overdue payment of invoices

Foetal surgery

Genetic deformities/disorders or birth injures

Genetic testing

Home visits,

unless they are medically necessary following the sudden onset of an acute illness, which renders the insured incapable of visiting their medical practitioner.

Hormone Replacement Therapy (HRT)

Impotence, sexual dysfunction

Parent Accommodation

Plastic surgery

Reimbursement for:

- Nutritional supplements and products that can be obtained without prescription

- Speech therapy, unless diagnosed as a phycical impairment

- Supplements and substances which are available naturally

Treatment arising from or related to ...

- a medical practitioner or specialist who is in any way kindred

- alcohol or drug abuse

- chemical or radioactive contamination from nuclear material or the combustion of nuclear fuel, asbestosis or any related condition

- communication therapy, floor time and family therapy

- cosmetic issues, obesity and any form of weight loss

- criminal, illegal or unlawful acts

- cryopreservation, implantation or reimplantation of living cells or living tissue

- deafness caused by ageing, and the provision of hearing aids

- eating disorders

- experimenal, unlicensed or unproven methods

- fertilisation, sterilisation, vasectomy or other sexually related conditions

- disobedience to follow medical advice, including travel

- disorders such as:

- adjustments

- antisocial behaviour

- attachment

- attention deficit hyperactivity

- autism spectrum

- conduct

- obsessive-compulsive (personality)

- oppositional defiant

- gender reassignment

- injuries sustained whilst engaged in a criminal, illegal or unlawful act

- laser eye correction, incl. refractive keratectomy (RK) and photorefractive keratectomy (PRK), unless the consequence of an accident

- personal choice, including Pregnancy Termination if not medically necessary

- piercing and tattooing

- plastic surgery, except for reconstructive reasons to restore funtion or apperance after an accident or surgery for cancer

- professional sports

- sexually transmitted infections (STD)

- sleep disorders, such as apnoea, snoring, insomnia and sleep related breathing problems

- suicide, bodily injury or illness that is wilfully self-inflicted, due to negligent or reckless behavior or caused by self-exposure to needless danger, except to save a human life

- surrogacy, whether acting as surrogate or intended parent

- war, terrorism, unless the person is an innocent bystander

Global Prima

Travel Insurance

- Area Options:

- Europe

- Worldwide, excluding USA, Canada and the Caribbean but incl. the Bahamas

- Worldwide

- Trip Options:

- Multi-trip

- Single-trip

- Up to 100 days cover for each trip

- No policy excess

- Option to included Golf package

- Option to include Winter Sports package

- Cover available up to age 74 yrs

- Plan Options:

- Silver

- €7.5 million / £6.25 million annual medical cover

- Trip Cancellation

- Trip Curtailment

- Missed Connections

- Emergency Medical Expenses

- Additional Hospital Benefit

- Personal Accident Cover

- Baggage & Personal Belongings

- Money

- Working Abroad

- Loss of Passport / Driving License Expenses

- Personal Liability

- Legal Expenses

- Optional Multi-trip Winter Sports cover package

- Gold

- €15 million / £12.5 million annual medical cover

- Trip Cancellation

- Trip Curtailment

- Missed Connections

- Emergency Medical Expenses

- Additional Hospital Benefit

- Personal Accident Cover

- Baggage & Personal Belongings

- Money

- Working Abroad

- Loss of Passport / Driving License Expenses

- Personal Liability

- Legal Expenses

- Replacement Business Associate

- Optional Multi-trip Winter Sports cover package

- Optional Multi-trip Golf cover package

- Silver

The ALC Health Prima Travel plans are underwritten by: Millstream Underwriting Limited on behalf of AWP P&C S.A.- Dutch Branch, trading as Allianz Global Assistance Europe

- Platinum

- Area of Cover

ALC Health insure 3 different geographical areas, which are:

- Area 1 - Europe with 58 countries*

- Area 2 - Worldwide (without USA)

- Area 3 - Worldwide

*Area 1 is defined as:

Albania, Andorra, Armenia, Austria, Azerbaijan, Belarus, Belgium, Bosnia & Herzegovina, Bulgaria, Canary Islands, Channel Islands, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Georgia, Germany, Gibraltar, Greece, Greenland, Hungary, Iceland, Ireland, Italy, Kazakhstan, Kyrgyzstan, Latvia, Liechtenstein, Lithuania, Luxembourg, Macedonia, Madeira, Malta, Moldova, Monaco, Montenegro, Netherlands, Norway, Poland, Portugal, Romania, Russian Federation, San Marino, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Tajikistan, Turkey, Turkmenistan, Ukraine, United Kingdom, Uzbekistan - Claim Handling

Claim Handler:

International Medical Group Limited

254 Upper Shoreham Road,

Shoreham-By-Sea,

West Sussex BN43 6BF

United KingdomTel.: +44 330 333 6686 (24h)

Fax.: +44 330 333 6687

WhatsApp: +44 29 2066 2410

Email: claims[at]alchealth.com

Web: www.alchealth.com/claims.htm

Pre-authorisations required:

aLC Health's Policy Wording on their Prima plans states that the following treatments/ benefits require pre-authorisation and should this condition not be fulfilled, they reserve the right to decline the claim in full or, in the event of in-patient or day-patient treatment, will pay only 50% of eligible benefits if treatment is subsequently proven to be covered.- Planned In-patient / Day-patient treatment

- All treatment

AND - Subject to at least 5 working days prior to admission or treatment appointment

- All treatment

- Out-patient

- Psychiatric treatment

- Psychiatric treatment

A claim can be pre-authorised before the visit to the doctor, specialist or hospital by calling ALC Health on 0044 330 333 6686 or emailing: preauthorisation[at]alchealth.com.

Claim submission deadline:

6 months, as of treatment date and regardless of policy status. - Planned In-patient / Day-patient treatment

ALC Health Announcements

05.05.2023 - New ALC Health Product

Introducing their new international private medical insurance product Global Prima Medical InsuranceSM, ALC Health offer five revised tariffs, optional add-on benefits and multiple annual policy excesses.

With this Global Prima replaces ALC Health’s legacy Prima plans and IMG'sGlobalFusionSM and GlobalSelect® products.

01.03.2022 - Introducing SiriusPoint & International Medical Group (IMG)

Carrier Change

ALC Health now being a part of IMG's global family brands, will undergo a carrier change for all plans renewed or purchased on or after 1st January 2022. The new parent company of ALC and IMG, SiriusPoint International Insurance Corporation is a top global insurer and reinsurer with a financial strength rating of A- (excellent) from rating companies such as: AM Best, S&P, and Fitch.

Expanded Product Lines with IMG

Being part of IMG’s global family of brands, coming soon ALC Health will introduce expanded product lines with IMG, which include a full suite of international full private medical and travel medical insurances, with telemedicine and Employee Assistance Program (EAP) services.

In addition, Patient Direct Billing facilitation has been extended to include the Quiron Group of Hospitals as well as other clinics and hospitals in Germany and Spain.

01.03.2022 - Improvements to the member area 'MyALC'

ALC Health has announced enhanced features available in the member area MyALC, the most convenient and efficient way for clients to access and manage their plans (link to MyALC).

| With MyALC you can currently: | These additional improvements are launching soon: |

|

|

For more information about MyALC and "How-to Videos" please follow this link.

18.03.2020 - COVID-19 (Coronavirus SARS-CoV-2) | Cyber Attack

Most recently, the COVID-19 outbreak has escalated into a global pandemic and we are closely monitoring the situation for any new developments.

We want to assure you that ALC has extensive experience working with governments and medical organizations to assist our members during serious medical situations, including all global health emergencies. Throughout this outbreak and after, customers can rely on ALC to be there for them during their travels.

We are currently experiencing a significant increase in the number of calls, emails, and inquiries to our team regarding COVID-19. We appreciate your patience as we quickly work to respond to all inquiries. For information regarding COVID-19 and how benefits may be affected, please visit our dedicated resource page, which includes frequently asked questions regarding IMG and ALC products.

Additionally, earlier in the year, ALC’s systems were down for an extended period due to a cyber incident beyond our control. Our systems were recently restored, but we are still working through our backlog of requests from this incident.

While there has been no evidence of a data breach or access, we are requesting all members reset their password upon logging into the ALC member portal as an additional security precaution.

We are actively working to return our service levels back to normal. Please note the following capabilities we will continue to utilize during this difficult time:

- Dedicated Customer Care team working additional hours to accommodate requests as quickly as possible

- Technology platforms as well as a dedicated Coronavirus Information page

- Chief Medical Officer and medical team on staff that are actively monitoring the outbreak

- Ability for ALC employees to work remotely, ensuring limited or no interruptions in service

For more important updates please visit their coronavirus resource page as new information is published here as soon as it becomes available.

24.09.2019 - BREXIT

ERICON broker would like to inform all our clients how as of 31st October, the expected date when the UK is to leave the EU, this could influence ALC Health's trading in the German market.

Over the last months ALC has appointed a new underwriter, 'XL Insurance Company SE', located in Ireland and therefore not subject to BREXIT.

Consequently, should the UK leave the EU, all Prima plans will not be affected, consequently are still valid in Germany, thus will not jeopardise a residence permit (VISA).

We would like to advise all our clients that we will react to safeguard your current situation in Germany as our commitment to you is to ensure that all our international insurance partners meet the set requirements and are registered with BaFin (German Federal Financial Supervisory Authority).

Therefore, should you decide that you may be at risk, please be assured we will work with you in securing an alternative.

Link to the official statement.

Frequently Asked Questions

Insurance - Health - International Private - aLC Health

I have ALC and live in Germany, do I have to purchase pregnancy cover?

On 1st March 2011 the European Union introduced a Directive which required all insurances to be non-discriminatory in respect of gender. This was originally intended to be aimed at property (motor) insurances but was extended to apply to all insurance sectors and came effective for health insurance on 21st December 2012.

German health insurances had always traditionally included pregnancy cover for all females – rates calculated according to age. Consequently rates for men were lower. When it was announced that unisex would be implemented to the health sector optimists believed the female rates would reduce to the male level – but of course insurance companies would not miss such an opportunity, and simply INCREASED the male rates to those of females. Naturally the men complain that they have to bear the cost of pregnancy cover and in return women however will now find that they are paying for the cost of prostate cover!

aLC never included pregnancy cover in their core benefits, which are and always have been, the same for male and female. As it always was – and still is – pregnancy cover is a separate option – not one of the core benefits. Therefore, it has not been necessary to rationalise the core benefit rates as they are inline with the EU Directive - being the same for both male and female. Also offering pregnancy as an option is also fairer – females who do not want this cover do not have to take it –EXCEPT if the German "Auslaenderamt" insist saying the insurance should be on the same lines as German insurance.

It is unlikely that any German insurer would adopt the same structure as aLC – they would after all be losing potential revenue!

The actual Law does not help too much as it relies on interpretation and the we have experienced that the Foreigners Offices also tend to apply their own ‘rules’ despite the Law.

I live in the Netherlands, hence does aLC provide full cover?

The health insurance act enacted by the Dutch government requires any person who is classed as a resident to hold a health insurance policy that includes cover for such things as chronic and pre-existing medical conditions. Latter are not covered or have been specifically excluded on the aLC Prima plans! For this reason and by Dutch law aLC Healthcare is obliged to advise their clients that any cover provided is 'additional' and/or 'supplementary' towards existing Dutch compulsory health insurance.

Is aLC legally accepted in Germany?

ALC Health, in conjunction with their underwriter Catlin Insurance Company (UK) Ltd., has authorisation in form of a irrefragably certificate from the German Financial Supervisory Authority (BaFin), confirming that their health plans Prima Classic, Prima Premier & Prima Platinum comply with requirements, hence are fully legal. With this authorisation aLC are eligible to trade in Germany and can offer health insurance to any resident in Germany, regardless of nationality.

The above-mentioned is subject of payment in line with §193 paragraph 3 VVG (German Insurance Contract Act) and must include dental and pregnancy coverage!

aLC increases my premium every year, why?

All insurances are subject to inflation, yet health insurance inflation is invariably higher than normal inflation. For a more detailed explanation please read this article.

If I cannot pay my premium on time, will my policy be cancelled?

ALC Health suspend cover on the 7th day after payment is due and unless payment is received by 21st day the contract will be cancelled due to non-payment! Once cancelled, a policy can however be reinstated, yet may require satisfactory completion of a health declaration.

It just takes 2 minutes to complete our aLC Health enquiry form to receive a quotation within 48 hours- this we guarantee!

Our obligation-free quote will not only state the premiums of all 3 suitable plans for Germany (Prima Platinum, Prima Premier and Prima Classic) but includes all information necessary to get a clear picture of aLC Health's Prima plans benefits and exclusions.